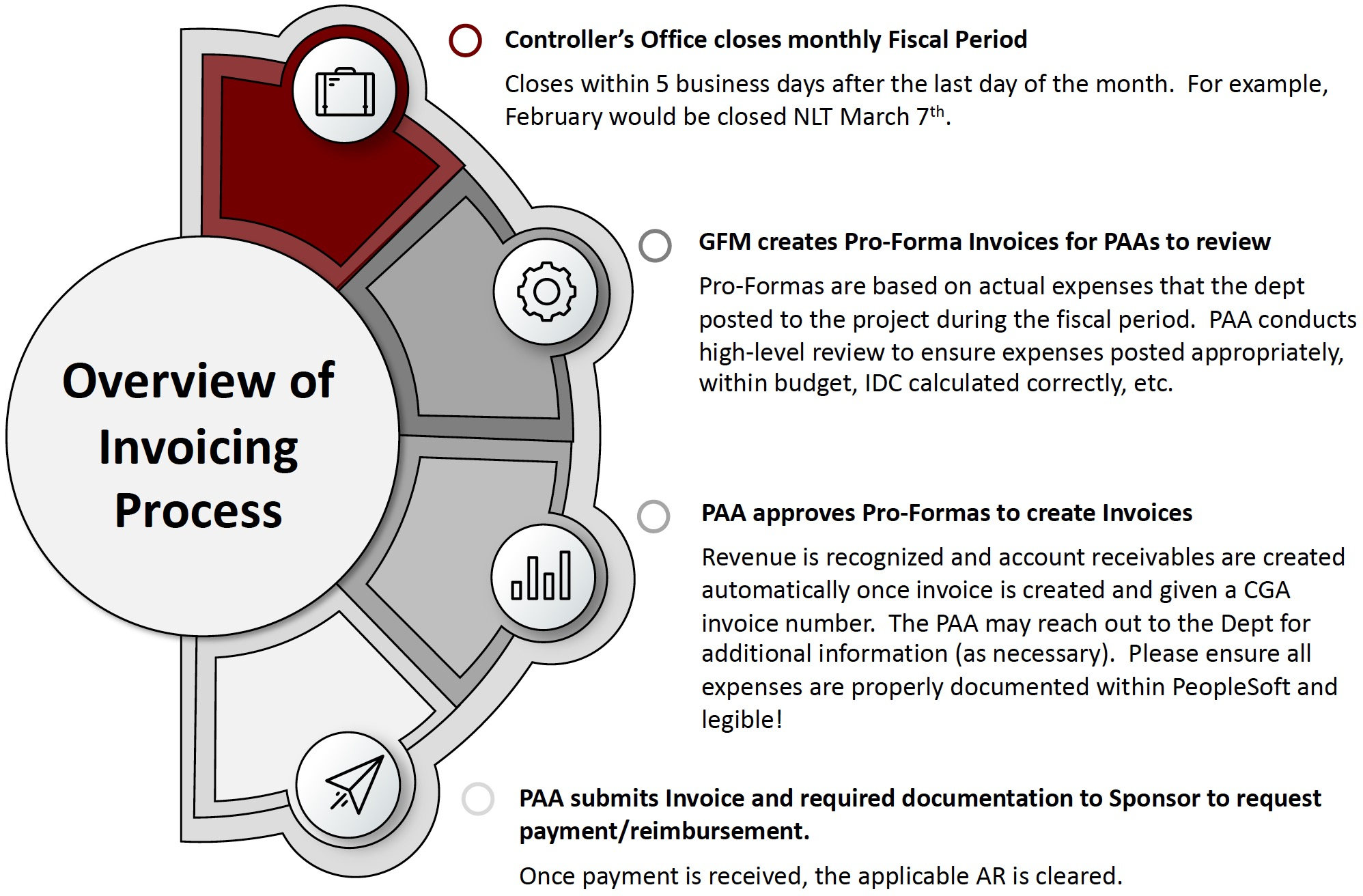

Invoicing sponsors is a major responsibility of the GFM. Department personnel should refer correspondence regarding invoice submission to the Post Award Accountant (PAA) assigned to the sponsored award.

Grant Support Staff and Principal Investigators (PI) should never invoice a sponsor nor promise an invoice by a certain day. Monthly invoices are prepared based on the expenditures posted to the general ledger in PeopleSoft Finance. Grant Support Staff and PIs should review the Finance Intranet (Grant Dashboard) monthly to ensure expenses are posted as expected.

GFM cannot invoice a sponsor if a project is on “Risk” or if the project is overbudget.

Invoices can only be prepared based on expenditures incurred and recorded in the general ledger. Normally final invoices for federal projects are due within 90 days; however, the notice of award should always be reviewed to determine when the final invoice is due.

There are two general categories of invoices:

- Cost Reimbursable: An invoice that itemizes project expenditures that have been incurred and requested for reimbursement by the sponsor.

- Fixed Price: An invoice for a fixed amount that is predetermined based on the payment schedule of an award and in some cases requires the completion of project deliverables or milestones to coincide with the invoice submission.

GFM provides monitoring and oversight of outstanding accounts receivable and performs ongoing collections for any invoices that are more than 60 days overdue. Collection efforts are initiated by the PAA and A/R Staff with department assistance as needed.

Factors that could result in non-payment are unsubmitted progress reports, missing deliverables, unallowable costs, and/or cash flow problems with the sponsor. The Department is responsible for covering any uncollectible balances due to unallowable costs, dispute with the sponsor, sponsor bankruptcy or any other reason.

If the Principal Investigator or department grant support staff learns from their sponsor that there is a payment problem, they should contact GFM so that measures can be put in place to avoid non-payment.