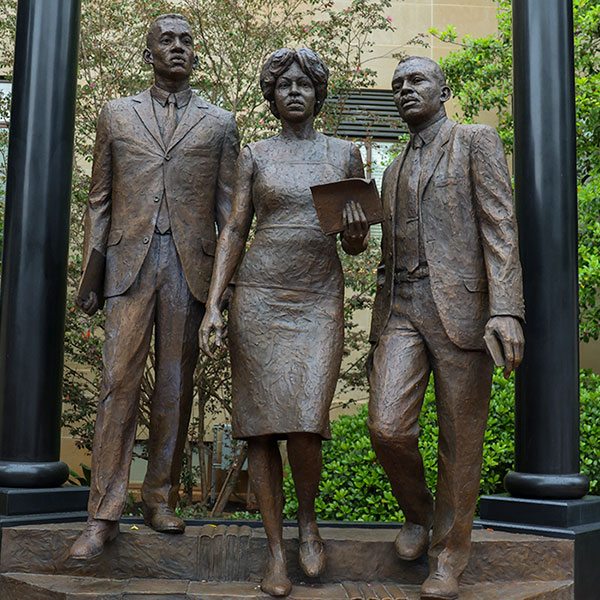

USC unveils monument honoring desegregation trailblazers

The University of South Carolina unveiled a monument honoring the first Black students admitted since Reconstruction — Robert Anderson, Henrie Monteith Treadwell and James Solomon Jr. — whose enrollment six decades ago changed the course of university history.